The Facts About Palau Chamber Of Commerce Revealed

Table of ContentsPalau Chamber Of Commerce - TruthsGet This Report about Palau Chamber Of CommerceLittle Known Facts About Palau Chamber Of Commerce.7 Easy Facts About Palau Chamber Of Commerce DescribedPalau Chamber Of Commerce Can Be Fun For AnyoneGetting My Palau Chamber Of Commerce To Work

Included vs. Unincorporated Nonprofits When individuals believe of nonprofits, they commonly think about bundled nonprofits like the American Red Cross, the American Civil Liberties Union Structure, as well as other officially created companies. Many individuals take part in unincorporated nonprofit associations without ever understanding they've done so. Unincorporated not-for-profit associations are the outcome of two or more people teaming up for the function of providing a public advantage or service.

In some instances, benefactors may begin with a much more modest ahead of time investment and after that strategy to add even more assets over time. Since ensuring recurring conformity with varied state as well as federal demands can show difficult, numerous structures involve specialist attorneys, company advisors, and/or various other specialists to help team with regulatory compliance and various other functional tasks.

9 Easy Facts About Palau Chamber Of Commerce Described

The properties stay in the trust fund while the grantor lives as well as the grantor might manage the assets, such as dealing supplies or actual estate. Palau Chamber of Commerce. All properties deposited into or purchased by the trust fund continue to be in the trust fund with revenue dispersed to the marked beneficiaries. These depends on can endure the grantor if they include a provision for ongoing management in the paperwork utilized to develop them.

This technique swimming pools all contributions into one fund, invests those incorporated funds, as well as pays the resulting earnings to you. Once you die, the count on disperses any remaining possessions to the marked charity. The easiest method to establish a charitable count on is with a significant life insurance policy, monetary solutions, or investment management business.

Additionally, you can work with a depend on attorney to aid you create a philanthropic trust and advise you on just how to manage it progressing. Political Organizations While many other types of not-for-profit companies have a minimal ability to get involved in or advocate for political activity, political companies run under different rules.

The Facts About Palau Chamber Of Commerce Uncovered

As you evaluate your options, make certain to seek advice from with a lawyer to identify the very best technique for your company and to guarantee its proper configuration.

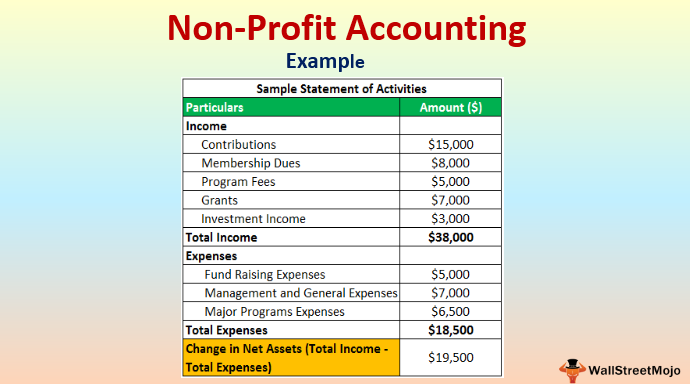

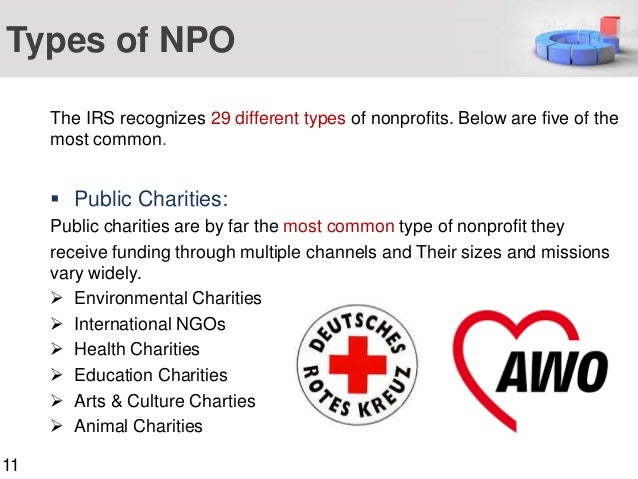

There are many kinds of not-for-profit organizations. These nonprofits are typically tax-exempt since they function towards the general public rate of interest. All properties and also revenue from the nonprofit are reinvested right into the company or donated. Depending on the not-for-profit's membership, objective, as well as structure, various classifications will use. Nonprofit Organization In the USA, there are over 1.

501(c)( 1) 501(c)( 1) are nonprofits companies that are organized by an Act of Congress such as federal credit unions. Since these companies are established by Congress, there is no application, as well as they do not have to file an income tax return. Payments are permitted if they are created public objectives.

Top Guidelines Of Palau Chamber Of Commerce

In the United States, there are around 63,000 501(c)( 6) organizations. Some instances of widely known 501(c)( 6) companies are the American Farm Bureau, the National Writers Union, and the International Association of Fulfilling Coordinators. 501(c)( 7) - Social or Recreational Club 501(c)( 7) organizations are social or recreation clubs. The function of these not-for-profit companies is to organize activities that lead to pleasure, leisure, as well as socializing.

501(c)( 14) - State Chartered Credit History Union and also Mutual Get Fund 501(c)( 14) are state legal credit unions and also shared book funds. These companies provide monetary services to their participants and also the community, normally at affordable prices.

In order to be eligible, at least 75 percent of participants need to be existing or past participants of the United States Army. Financing originates from donations and visit their website also government grants. 501(c)( 26) - State Sponsored Organizations Offering Health And Wellness Protection for High-Risk Individuals 501(c)( 26) are nonprofit companies developed at the state level to supply insurance for high-risk individuals who might not have the ability to obtain insurance policy via various other ways.

The Single Strategy To Use For Palau Chamber Of Commerce

Funding originates from donations or government grants. Examples of states with these risky insurance policy swimming pools are North Carolina, Louisiana, and also Indiana. Palau Chamber of Commerce. 501(c)( 27) - State Sponsored Employee' Settlement Reinsurance Company 501(c)( 27) nonprofit organizations are produced to supply insurance coverage for workers' payment programs. Organizations that give employees settlements are called for to be a member of these organizations and also pay dues.

Palau Chamber Of Commerce - The Facts

We talk about the actions to becoming a nonprofit additional into this web page.

One of the most crucial of these is the capacity to obtain tax "excluded" standing with the internal revenue service, which allows it to receive donations devoid of my company gift tax obligation, enables contributors to subtract contributions on their tax return as well as excuses a few of the organization's tasks from earnings tax obligations. Tax excluded status is vitally important to lots of nonprofits as it motivates donations that can be utilized to sustain the objective of click here now the organization.